The Pros and Cons of Buying a Fixer-Upper

The Pros and Cons of Buying a Fixer-Upper

Buying a fixer-upper can be an exciting opportunity to create the home of your dreams or invest in a property with potential. But before you break out the toolbox and paintbrush, it's essential to weigh the pros and cons of this unique type of real estate purchase. Let's take a look at some of the benefits and challenges of buying a fixer-upper so you can decide if it's the right move for you.

The Pros of Buying a Fixer-Upper

Lower Purchase Price

Fixer-uppers typically come with a more budget-friendly price tag. If you're willing to put in the work, or have the extra funds to hire contractors, you can often get more house for less money compared to a move-in ready property.

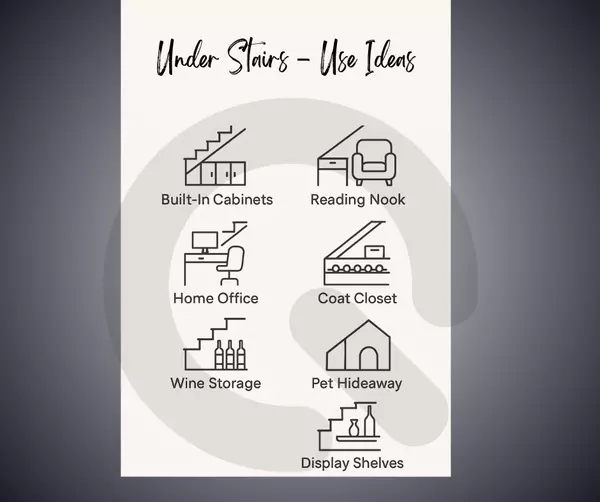

Customization Opportunities

One of the biggest draws of a fixer-upper is the ability to personalize the space. You get to choose everything - from flooring and paint colors to kitchen layouts and bathroom finishes - to suit your style and needs.

Potential for Increased Value

Renovations and updates can significantly boost a property's market value. If done wisely, this can lead to a solid return on investment when you decide to sell.

Less Competition

Move-in-ready homes often attract a large pool of buyers, creating multiple offers and potentially driving up prices. Fixer-uppers, on the other hand, tend to have less competition, giving you more negotiating power.

Opportunity for Sweat Equity

If you're handy or willing to learn, you can save money by doing some of the renovations yourself. This "sweat equity" can translate into substantial savings and a sense of accomplishment.

The Cons of Buying a Fixer-Upper

Hidden Costs

What looks like a simple cosmetic fix can sometimes reveal costly structural or mechanical issues. Unexpected repairs can quickly eat into your budget, so a thorough inspection is crucial.

Time-Consuming Renovations

Renovating a fixer-upper requires time, patience, and effort. Projects can take months - or even years - to complete, which may not be ideal if you need to move in quickly.

Financing Challenges

Traditional mortgages may not cover the cost of extensive repairs or renovations. You might need a specialized loan, like an FHA 203(k) or Fannie Mae's HomeStyle Loan, or a construction loan to finance both the purchase and the work.

Stress and Uncertainty

Managing contractors, navigating permits, and dealing with unforeseen setbacks can be stressful. Without careful planning, renovations can spiral out of control.

Limited Livability

Living in a home under construction can be challenging. Depending on the extent of the work, you might need to budget for temporary housing or learn to live amid the chaos.

Tips for Buying a Fixer-Upper

Get a Home Inspection: A thorough inspection can uncover major issues and help you estimate renovation costs.

Set a Realistic Budget: Factor in both the purchase price and renovation expenses. Always include a contingency fund for unexpected costs.

Prioritize Projects: Focus on essential repairs first (roof, plumbing, electrical) before tackling cosmetic updates.

Work with Professionals: Consult with contractors and designers to get realistic estimates and timelines.

Understand Your Limits: Know when to DIY and when to call in the experts to avoid costly mistakes.

FAQ's About Buying a Fixer-Upper

Q: How do I know if a fixer-upper is worth it?

A: Compare the home's purchase price and estimated renovation costs to the potential market value after repairs. A real estate agent can provide a comparative market analysis to help you decide.

Q: Can I finance the renovations?

A: Yes. There are loans specifically designed for fixer-uppers, such as FHA 203(k) loans or Fannie Mae's HomeStyle Loans, as well as construction loans that will cover both the purchase price and renovation costs.

Q: How do I estimate renovation costs?

A: Work with a few contractors to get detailed quotes for the work. Be sure to include permits, materials, labor, and a contingency for unexpected expenses.

Q: Are fixer-uppers only for experienced renovators?

A: Not necessarily! First-time buyers can succeed with careful planning, a solid team of professionals, and realistic expectations.

Q: What's the biggest risk of buying a fixer-upper?

A: The biggest risk is underestimating the time, cost, and effort required for renovations. A detailed plan and contingency budget can help mitigate this risk.

Buying a fixer-upper isn't for everyone, but for those up for the challenge, it can be an incredibly rewarding experience. Whether you're looking to craft your dream home or secure a profitable investment, understanding the pros and cons is the first step toward making an informed decision.

Thinking about taking the plunge? Let's chat!

Categories

Recent Posts